Is directors medical expense tax-deductible in Malaysia. Directors fees approved in arrears.

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

We are in equal share stake 50 - 50.

. 3399 total views 2 views today. Updates and Amendments 32. Medical treatment special needs and carer expenses for parents.

19 NOVEMBER 2019. INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text DATE OF PUBLICATION. Director General of Inland Revenue Malaysia.

Granted automatically to an individual for themselves and their dependents. Declaration of bonus or director fee 2021 although payment made in 2022 are eligible for tax deduction. Under section 131 b Income Tax 1967 medical and dental benefits are exempted from income tax for employees.

KTP Company PLT AF1308LLP0002159-LCA In general medical fee on employee is tax deductible under S 33 of the Income Tax Act 1967 AskKtpTax AskThkAcc. Ive run a Sdn Bhd company since last year. We have steady monthly 5 figure business profit.

Quickly jot down and share to your friends. Payments to foreign affiliates. If you provide private medical insurance for an employee this is considered a benefit in kind.

Actually - sue the company is the right answer If it is as a result of the working conditions and obviously the medic should confirm this in writing then the claim is for the damages as brought about by this ie. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. More on what qualifies for tax deductions.

The company voted and approved directors fee of 20000 on 30 Jun 2020 to be paid to you for your service rendered for the accounting year ended 31 Dec 2019. TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy. It sets out the interpretation of the Director General in.

The remuneration package of non-executive directors is conventionally made up of director fees board and board committee fees meeting. Resident companies are taxed at the rate of 24. 112019 - Benefits In Kinds.

Directors Remuneration and Tax Planning- Evidence from Malaysia. 112019 - Benefits In Kinds. Here is the list of Company Tax Deduction in year 2021.

By Thursday 12 January 2017 Published in Tax Planning. TAX TREATMENT OF LEGAL AND. Special relief for domestic travelling expenses until YA 2021.

In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. Weve 0 employee as me and partner running the business by own. Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia.

In Budget 2020 to provide additional flexibility to. Under section 131 b Income Tax 1967 medical and dental benefits are exempt. 19 rows Additional deduction of MYR 1000 for YA 2021 increased maximum to MYR 3000.

Entrance fees to tourist attractions. KTP Company PLT AF1308LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd. A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities.

Declare Bonus or Director Fee in Accrual Basis. Director medical fees tax deductible malaysia 1. Monthly Tax Deduction MTD 31 11.

And deduct and remit the Monthly Tax Deduction PCB to the IRBM by 15 Jan 2020. - Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. For example if you take up a job while overseas and you only receive the payment for the job when you are back in.

WITH the income tax deadline a mere day away the Inland Revenue Board coordinated by the boards corporate communications director Nor. Medical benefit child care benefit transportation fee for interstate travel. VICTOR CHOONG must report this director fee income in respect of year 2019 in his Form BE 2019 or Form B 2019 even though he has only received the fee on 10 Jan 2020.

Directors Remuneration and Tax Planning- Evidence from Malaysia. What you can read next. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and proced ure that.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK. Is directors medical expense tax-deductible in Malaysia.

Non-deductible legal and professional expenses 3 6. Why is Tax Planning so Important. Now we are planning to have payout from company as we didnt draw a single cent since beginning.

Effective date 5. Your fee will be treated as income for. Individual and dependent relatives.

Were thinking of payout director fees. Medical expenses travelling loss of earnings etc. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board Malaysia.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA under the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU. Section 138A of the Income Tax Act 1967 provides that the Director General is empowered.

Youre required to pay National Insurance contributions at 1505 202223 tax year and your employee will pay personal tax. Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. Deduction Claim By Employers 31 12.

Statutory audit fees expenditure PUA 129 - Income Tax Deduction For Audit Expenditure Rules 2006 54 Defending title to property. Youre required to pay tax on gifts and benefits that dont meet the above conditions. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

AskKtpTax AskThkAcc 260422 2. 14 Income remitted from outside Malaysia. Heres a more detailed look at the fine print behind each income tax relief you can claim in 2020 for YA 2019.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

We Are Hiring Operations Management Recruitment Agencies Job Hunting

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Updated Guide On Donations And Gifts Tax Deductions

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Making Machine 30000pcs In Stock Medical Gown Protective Uniforms Making Machine Making Glass Enigma Machine

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Director Medical Fees Tax Deductible Malaysia

Competing Companies Tardy Procurement Low Signup Rates Plague Country Malaysia Covid 19 Faded

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Payment

Personal Tax Relief 2021 L Co Accountants

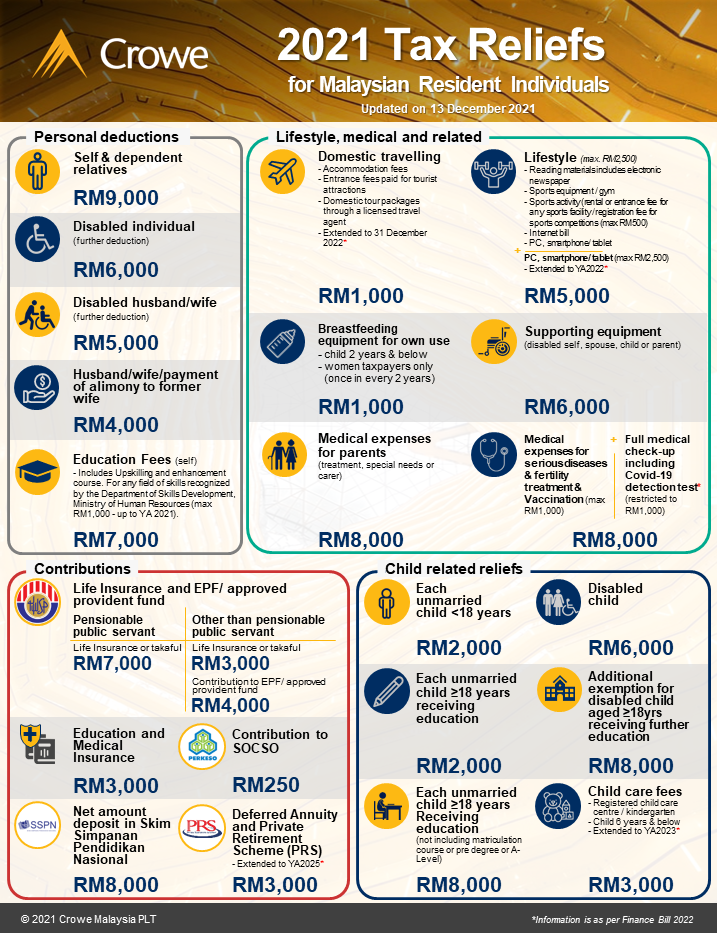

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

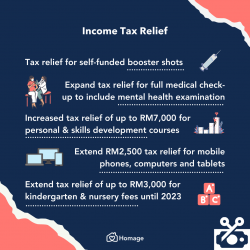

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Tac Your One Stop Tax Solution Home Facebook